On 10 December 2025, the students of the MIBE Master’s Programme – Master in International Business and Entrepreneurship attended the seminar “The role of ESG in M&A deals”, delivered by Dario Brichese, Investment Manager at DeA Capital Alternative Funds.

The session took place in Aula FL, Palazzo San Felice (UNIPV) and offered an insightful overview of how ESG criteria are reshaping investment strategies, M&A processes, and value creation in the private equity industry.

The seminar explored the growing importance of ESG, Environmental, Social & Governance factors in today’s financial landscape. As highlighted in the presentation, sustainability is now strongly linked to business performance, investor confidence, and regulatory compliance, becoming a fundamental element of long-term value creation.

A significant portion of the session was devoted to explaining the European regulatory framework, which is currently driving profound change across the investment market:

- the EU Green Deal and Europe’s climate transition strategy;

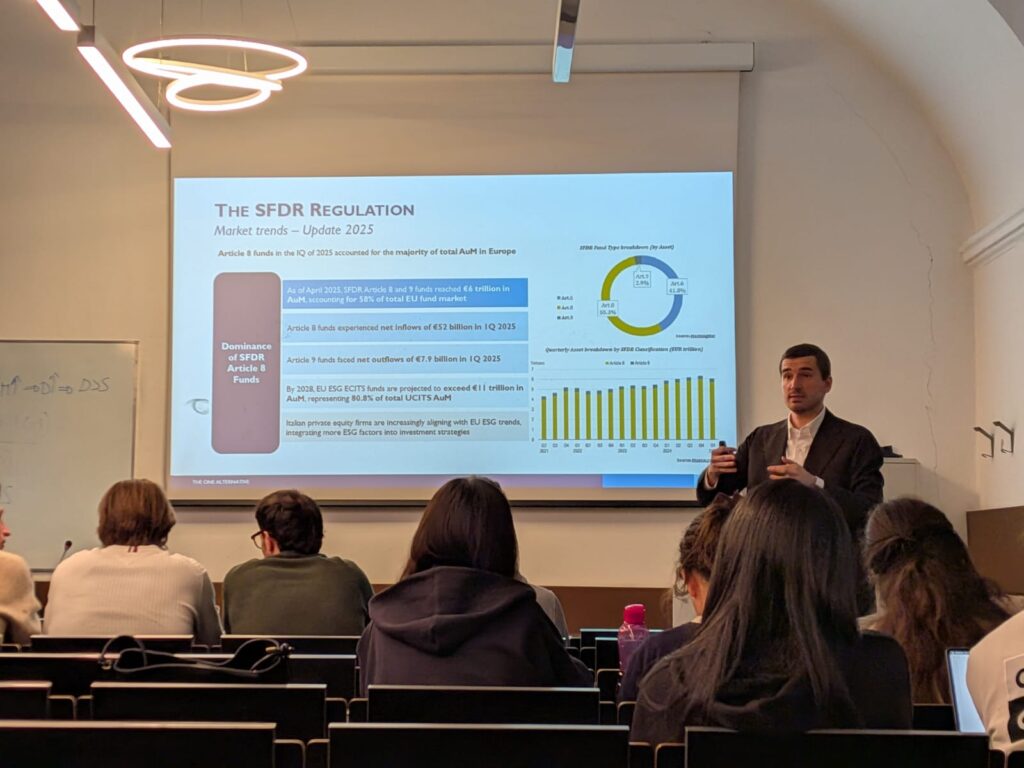

- the SFDR, which classifies financial products into Article 6, 8, and 9 based on their ESG integration level;

- the CSRD, introducing more stringent sustainability reporting requirements;

- the EU Taxonomy, a classification system that identifies which economic activities qualify as environmentally sustainable

These regulations are shaping investor behaviour, as seen in the rising market share of Article 8 and 9 ESG funds throughout Europe.

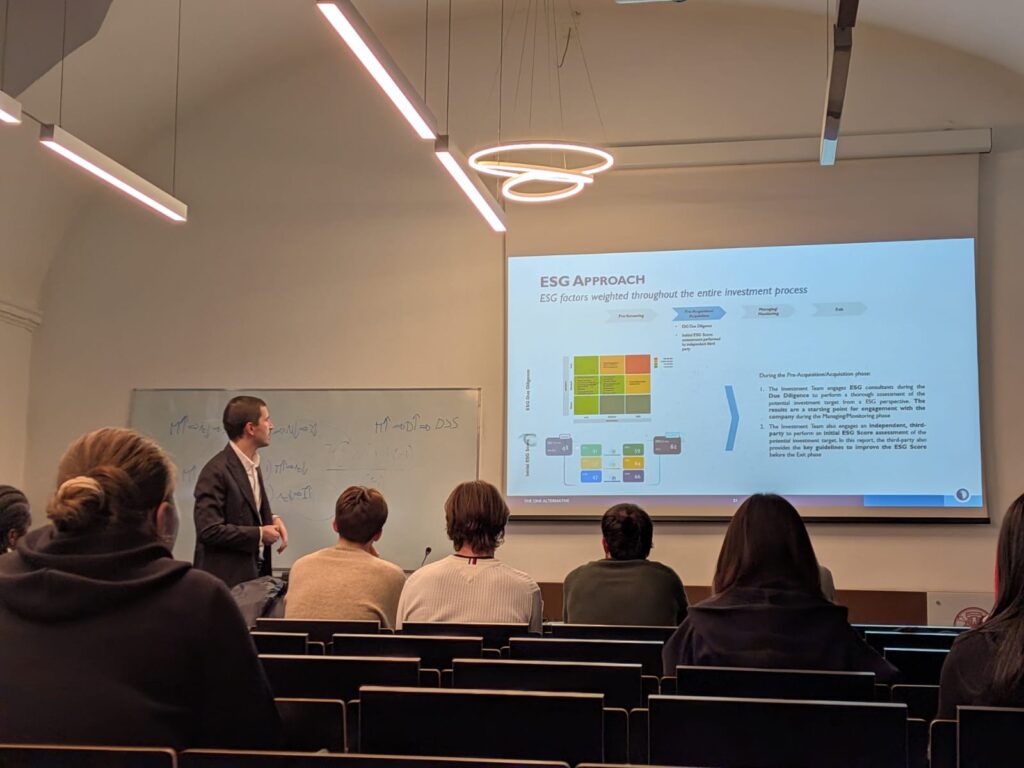

The seminar then focused on DeA Capital’s ESG integration model, which embeds sustainability into every phase of the investment cycle: from pre-screening, to ESG due diligence, the development of a 3-year ESG Action Plan, and the assessment of ESG improvements at exit.

This framework, supported by tools such as the Value Creation Tool, ensures systematic monitoring and continuous enhancement of ESG performance across portfolio companies 2025.

Finally, a case study on OMB Saleri was presented, illustrating how ESG-driven initiatives can strengthen governance, foster employee engagement, support product innovation, and ultimately increase a company’s attractiveness and market value during an exit process.